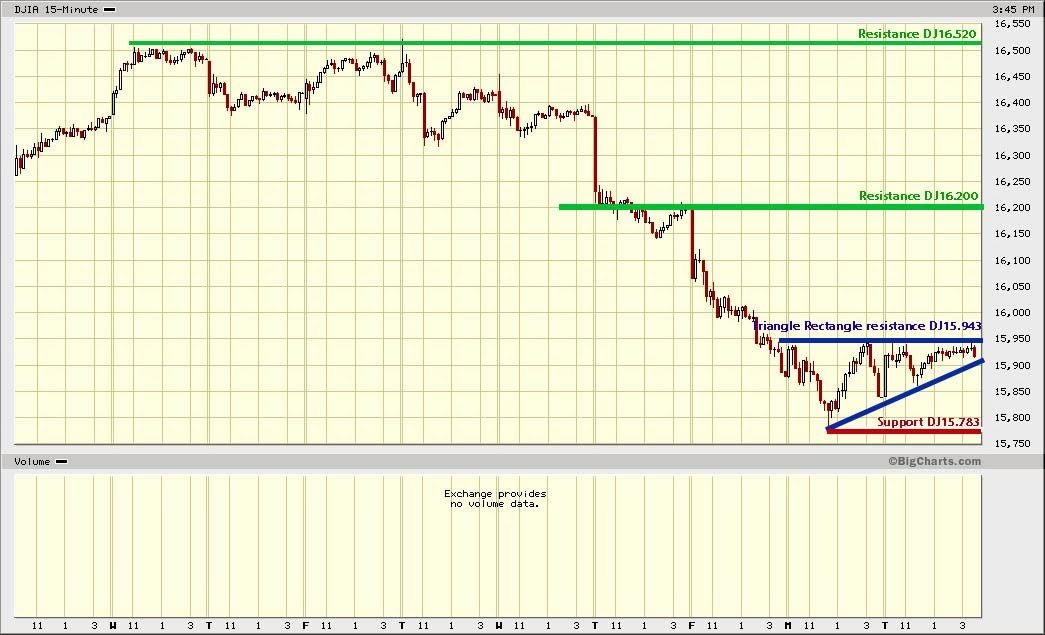

16.577 All-time high close

16.520

16.200 Important

16.155 50 days moving average

15.943 Monday's high

DJ Support : 15.783 Monday's low

15.700 Strong (approx. Aug.,Sep., Oct. peaks)

15.405 200 days moving average

14.760 Strong (support old range 14.760 - 15721)

Technical Analysis :

The break down through support DJ16.174 and 50 days moving averages have caused significant technical damage to the Dow Jones Industrial Average and the bias shows the lower direction. The DJ needs to overcome DJ16.200, the 50 days moving average and stays over them to neutralize made damages.

In the short term, the DJ has formed a triangle rectangle with an upside bias.

The DJ is supported at DJ15.700 (approximately August, September and October peaks). This area should be a strong support as it was a strong resistance in 2013. It took seven months to penetrate, retest and perform new highs.

It is time to be cold during this battle. If this level supports, we are going to see a consolidation, if not, correction. Right now it is very easy to be wrong because if market supports and goes up, it could be a trap to sell at higher prices. DJ15.700 is the line in the sand, over is positive, below negative. It seems the bull market is not over.

Please click over the charts to enlarge them.

Fundamentals:

The market has corrected and what we have to determine is if the correction will continue. The frontier is DJ15.700.

The Dow Jones Industrial Average has increased 28% in 2013 without a correction of 10% at least. The last one was in 2011.

Is the DJ tired? No, a lot of investors are frustrated because they are out waiting for a new opportunity to jump into the market at lower prices. They need a correction for that.

In the fundamental, the main culprit in this decline and possible continuous correction are the concerns over U.S.A. corporate earnings, several major economies are slowing like China last week PMI Flash Manufacturing Index at 49.6, the weakness in the emerging countries as the devaluation of the Peso in Argentina and the Lira in Turkey.

In general the U.S. is doing well. We have to see the January unemployment figures. The market is expecting 2.8% PBI fourth trimester growth against 4.1% third trimester. My concern is about consumption, last week Consumer Sentiment and today's Consumer Confidence improved in January but Best Buy, Target, etc. are closing stores and laying off staff. I still see growth in 2014 and 2015 for the U.S.A. economy as well as European, China, Japan and emerging countries' economies.

Dear traders and investors, the FED tomorrow will show us its tapering policy driven by Ms. Yellen. Normally January brings gains for the stock market, February and March loose. Let's see how January ends.

Good luck, viel Glueck, buona fortuna, buena suerte, bonne chance!

Ulises

No hay comentarios:

Publicar un comentario